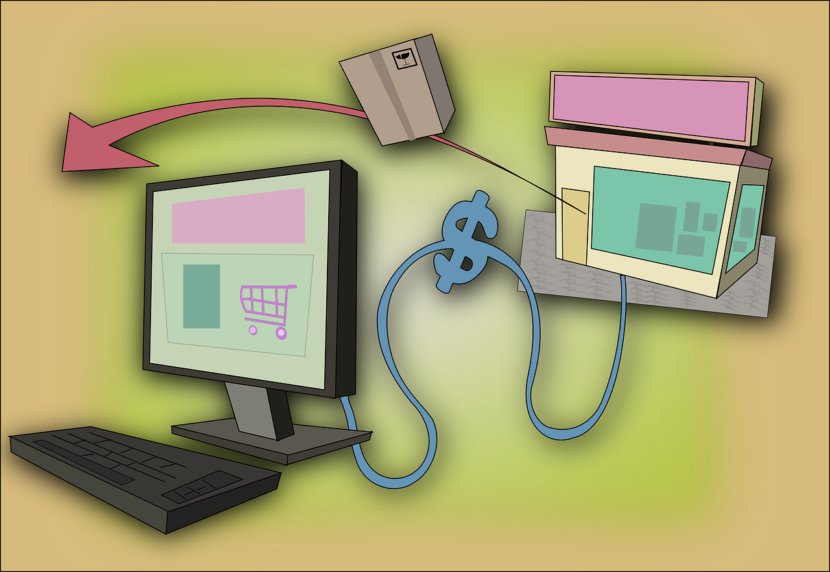

One of the most relevant aspects in electronic or digital commerce are the means of payment from which purchases can be formalized. To the point that these financial systems have been gradually expanded to facilitate these operations for users. Not only are the more traditional mediaIf not, others have been incorporated from the new digital media. So in the end your options are much more powerful than before.

So that you know how you can make these commercial purchases, we are going to show you which are the means of payment that are enabled by the digital platforms responsible for the sale of products, services or items. You may take the odd surprise that you can use from now on. In this sense, it is a list that is renewed year after year and from which both parts of the commercial process can benefit.

In many cases, whether a customer opts for purchases will depend on the means available to execute the payments for commercial transactions. For this reason, it is very important that they have a very wide offer that can help them make the decision to accept this business model. The more there are, the greater the business opportunities from now on.

Payment methods: the most traditional

Any self-respecting online store or business must provide the traditional credit cards and due. Because it is a format that is always present among users or customers and all cards made by financial institutions must be accepted. Where both parts of the process always will benefit of this business process. Because they are generally exempt from commissions and other expenses in their management or maintenance. And if there are, they will be for very undemanding amounts compared to other formulas to formalize payments derived from purchases.

In this sense, it cannot be forgotten that they are very easy to use and only require a liquidity fund or, failing that, a credit previously approved and granted by the banks. So that in this way the operation can be completed very quickly and with the efficiency required from both parties. Not surprisingly, they are very easy to use and are available to almost all customers.

Another more traditional means of payment is bank transfers and in any case it is losing influence in terms of its impact on making payments in digital stores. Bank transfers are money transfers made to the order of a client from their bank account in an entity (originator) to another designated one (beneficiary). If it is made between accounts of the same bank, it is called a transfer. They can be in two ways, depending on the digital stores where purchases are channeled.

- National transfers: Both the payer and the beneficiary are in Spain.

- Foreign transfers: Those in which the beneficiary is in a country other than the originator.

Electronic means of payment

It is the emerging payment in this class of commercial operations and it consists of different formats.

Virtual currencies

They are more used in very pure online transactions and environments and in international markets. Bitcoins have been very famous for suffering some instability in the markets and not all potential customers are familiar with their use.

PayPal

It is a means widely used by those customers who buy very often online and they are also very aware of cybersecurity. It is very versatile and convenient to manage returns, as is often the case with digital purchases. To the point that it is one of its most valued contributions by users.

Payment via mobile

The classic means of payment preferred by early adopters. It is comfortable, fast and functional, but its penetration in the market is still not enough to be a card to play everything for everything. It is a means of payment that is on the rise in digital media and that can affect the acceptance of new customers or users. They are highly secure as they have preventive measures to guarantee the operations that users are going to carry out. Because at the end of the day it is one of the objectives of this kind of commercial movements.

Virtual currencies

There have been many disparate criteria since virtual currencies emerged, especially cryptocurrencies with bitcoin as the one that has achieved the most strength and recognition (although there are other cryptocurrencies such as Etherum, Litecoin, Dash). From the beginning, the gradual use of cryptocurrencies in the system of economic relations, meant that the trust that was previously placed between human beings in monetary relations, was suddenly transferred to a mathematical code. With this, the revolutionary character associated with cryptocurrencies since their emergence could be explained a little.

smile to pay

An online payment system with facial recognition that works thanks to 3D technology and different built-in verification processes that make it possible to pay with a simple smile. It is an initiative of the Chinese multinational Alibaba and makes it easier for a customer to pay without carrying cards or mobile phone. If the customer has an Alipay account, they can use this payment option without any problem.

Pay with a selfie

Another initiative that takes advantage of biometric recognition, this time to pay with a photo at the time of purchase. It is in the initial testing phase and it is expected that this option will correct many of the errors that were generated with this technology in facial recognition unlocking.

In short, there are many options that users have to formalize this kind of purchase through online channels. With the goal that more and more transactions are developed in the commercial field and that they can be accepted by customers.