Surely you have experienced as a customer in electronic stores, on various occasions and now that you are the owner of one of them, you wonder how you can improve the experience of your customers on your site.

A satisfied customer is a secure customer for future visits and purchases, a value of expansion through social networks or word of mouth.

When a customer walks into a store, they expect to find one intuitive navigation of the site, a clear design that does not lead to confusion, options search and other direct or indirect aids that will urge them to stay on your page and even come back.

If your store is a safe place, with good navigation and with accessories that help your customer in their decision about the products and finally their purchase, you cannot miss the star service that is undoubtedly the payment gateway.

What is the payment gateway?

La payment gateway is a service that is implemented in electronic stores, to make it easier for customers to pay. Depending on the payment gateway you use in your store, you will get a better or worse experience for your customers when it comes to paying.

Obviously, what you want is for your customers to browse, consult and buy in a comfortable, fast and secure way and when it comes to paying you don't want the quality to decrease. It is useless to have the best design or most desired products, if when your customer wants to pay for their content in the shopping cart, everything gets complicated with what they cannot or do not know how to pay.

If we review the experience of hundreds of e-shop customers when paying, we get a series of tips and recommendations that will make your store the ideal place when making the payment, avoiding the mistakes that other sites make by not understanding the customer.

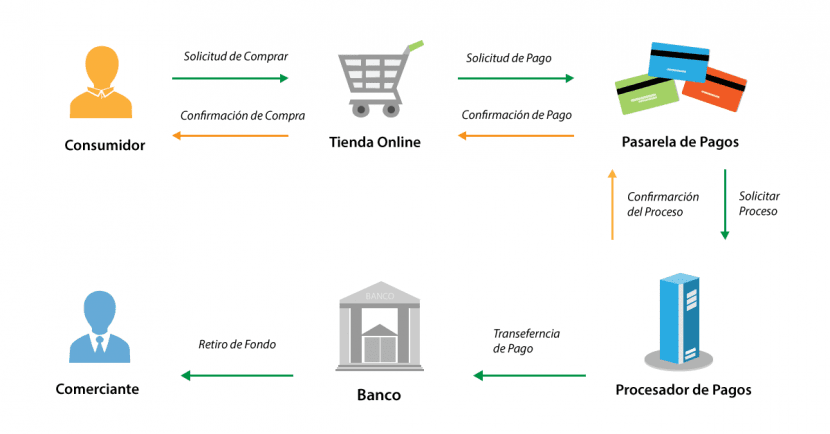

The operation of a payment gateway is quite simple:

When the customer completes the purchase and proceeds to payment, he uses a debit or credit card number and inserts its data in the space requested by the platform.

El The customer's browser encrypts the data to send it to the store where he has purchased. What encryption does is send the protected data so that it cannot be "hidden" by third parties and read. The SSL (Secure Socket Layer) or TLS (Transport Layer Security) system is used to encrypt the data.

Now the customer's data is incorporated into the store's payment platform, which is also encrypted and secure.

The payment platform contacts the vendor bank platform and gives you the customer's card details.

The bank, in turn, forwards the information to the client target platform, to verify that the data is correct and to carry out the authorization.

The customer's bank verifies the data and, if they are correct, sends the authorization to the seller's bank along with an approved message. If the client's bank does not approve the operation, it also sends a message with the cause, for example "lack of funds" or "connection not available".

Although at first glance it may seem like a complicated operation, it only takes a few seconds until all platforms communicate and the customer's bank issues a message approving or rejecting the operation.

Customer experience when paying

If we take into account the wishes of our customers when choosing the products we sell, we listen to them when they criticize the garish color of our design or advise us to make a change in the store, we must not leave aside the most important of all: payment.

The customer is always willing to tell your experience When you have finished using a site and if we make a summary of the problems that you have had throughout your visit and among them is the difficulty when using the payment platform, it is not a good thing.

My client has taken his time deciding what he wants to buy from me, he has taken it to his cart or shopping basket, he created his account and then he is ready to pay but ... it has not been possible for various reasons. What will my client do? Indeed, what you are thinking, will leave my store without buying and also with a bad experience that he will be happy to share with whoever wants to listen to him.

So, it is clear that a bad payment gateway in our store is a determining factor and that intervenes directly in the poor sales of our store.

Some bad customer experiences when it comes to checkout should put you off so your store doesn't make the same mistakes. Let's look at some of the difficulties expressed by customers when using a payment gateway:

- "It seems to me inadmissible that an electronic store does not have the option of payment through PayPal. "

- “When trying to pay with a card, it returns an error message and I have tried it with several cards. You can't waste any more time trying to pay. "

- "The payment platform does not seem secure to me, it has a design that I have never seen and I do not trust too much."

- “When I choose the payment method, it sends me to a page outside the store if I give notice and I don't trust it."

How can I improve the payment gateway?

We are already clear that we want our customers to have a wonderful trip in our store, from the beginning choosing the products, browsing, asking questions and finally paying. Now it remains to carry it out.

First you have to observe if your payment gateway contains any of these errors:

- Does not convey confidence

- It is difficult or confusing to use

- Appears out of place or poorly designed or

- Redirect to other pages without avian client

Only with one of these previous cases would be reason enough to change things, if even so, you find all the errors in your payment gateway, it is clear that your customers are leaving your store alarmingly ... without buying.

It is imperative that you take action and update your payment gateway. So that your customers do not distrust and make their payment secure and without pulling their hairs, you have to take measures:

FIRST_ FAMILY PAYMENT METHODS. All the most common payment methods must be offered, using logos that are known to the naked eye (Visa, Mastercard ...), so as not to mislead the customer. When you are paying and you quickly see the logo of your card, you feel identified and you are not out of place.

SECOND_ REDIRECTION NOTICE. If you have chosen a payment option in which you are sent directly to the page or server of the person offering that payment (such as PayPal), it is important that you communicate this to your client with a pop-up message that informs them. You should know that to complete the payment transaction, you will go to another page outside your store, but that it is safe. When you use payment platforms that send their page to your client, such as PayPal, it is usually an extra trust for the client, since it is a well-known and secure payment page.

THIRD_ USE SECURE AUTHORIZED LOGOS. When you use a logo and the client clicks on it to make a payment, it must be a secure link with an SSL certificate. You just have to buy an SSL certificate and install it in your store to ensure payment transactions for your customers.

Pros and cons of third-party payment gateways

As we have already said before, in sometimes we use payment methods such as PayPal, that uses its own page to make the payment, so the customer will be forced to leave the store in which he was buying, to be able to pay. It is important to always notify the customer that they are going to leave your store to enter another, but you must always inform them that the entire transaction is 100% secure.

On the one hand, it is a very safe habit, because you avoid implementing security certificates since the payment platform itself has them. You avoid the customer having to enter their personal and payment data, since their debit or credit card is already linked to the payment platform.

Disadvantages of third-party payment gateways:

Not all customers willingly accept abandon a page to enter another and make a payment, even if it is well known.

It's strange sending your customers to pay another place other than your store.

Benefits of third party payment gateways:

When the platform you use so that your customers can make the payment in your store, it is known like PayPal, Google Wallet or Stripe, the customer feels even more secure.

In some countries, payment through third-party platforms, is the most recognized and reliable payment. If you are going to sell to other countries, find out if they consider these platforms safer than that of the stores themselves.

How many fewer screens have the client to navigate, the better. By sending them to another platform to pay, you simplify the entire process.

You avoid the client a long process of record and entry of data that can make them think twice about continuing to shop at your store.

Concluding: An essential part in the user experience of your store, is the payment gateway, study well what methods to use, and offers fast and intuitive information and methods, and your rate of abandoned shopping carts will decrease, and your customer satisfaction will increase .

When I implemented Cardinity payment gateway in my online store, I saw an instant increase in sales because my clients have the opportunity to pay with credit or debit cards.

Thank you very much for the information. I had some confusion between what was the payment gateway and what was the payment processor. The issue became clearer to me.

In order to create a new payment gateway, do I have to paste it into the payment processor banking system? Right or wrong?

Is this a simple process or is it complicated, in Guatemala?

they help me

Thank you

Thank you very much for excellent information.

excellent information